Warehousing and Distribution

Article | July 11, 2023

A sector which has been heavily disrupted in the last years is the mobility sector. Following decades of "car being king", we have reached a saturation and mentality shift. People want to be more healthy and more ecological (sustainable) and also avoid losing precious time in traffic jams. As a result a whole eco-system of companies has been created to find solutions for this.

This article tries to provide an overview of the trends in this market, with a focus on the Belgian market.

First of all when looking at mobility and the offers on the market it is important to make a distinction between private and professional displacements. This last category can additionally be split up between the daily commute and professional displacements during working hours.

When looking at private mobility (the so-called B2C market), the car remains an important pilar. Especially for families with (young) children it remains difficult to do everything without a car. Obviously, there is a trend to be more sustainable, which is reflected in more sales of hybrid and electric vehicles, more usage of (e)bikes and (e)steps and an increasing usage of shared mobility options (like shared bikes, steps or cars).

Statistics from China, which is already the furthest in the post-Covid era, show that most mobility options have lost terrain (compared to pre-Covid), with the exception of the car and bike. The car, although still not very sustainable, is still the most flexible and has the least chance for contamination. Especially the flexibility will become more important as office hours also become more flexible. Additionally due to the increased home working, in some cities traffic jams have considerably reduced, making room again for more people to switch back from public transport to their car.

Additionally there is the bike. This is a very flexible, individual, healthy and sustainable mode of transportation that many have discovered during the crisis. Furthermore with ebikes becoming more and more common, bigger distances can be covered without needing to be in excellent physical shape.

The professional mobility (i.e. B2B(2C) market) is however even more in evolution, as governments provide all kinds of fiscal incentives to change the mobility habits of employees and employers. Furthermore employers want to offer more flexibility (in working hours, in working location and in mobility options) and less administrative burden to their employees, allow them to profit from those fiscal incentives (resulting in an increased buying power) and become more sustainable.

As a result a variety of new offers to be more flexible and optimally profit of those extra-legal advantages has come to the market. This makes it very complex for an employer to find his way in this tangle.

Obviously, every company is unique, with multiple axes determining which mobility options are possible and best suited for the company:

The location of the company, i.e. Is the company situated in a city with a lot of mobility difficulties (traffic jams)? Is the company situated near public transport options? Is the company situated in a city where a lot of shared mobility options are available? Are the employees typically living close or far away from the company? Which kind of parking facilities does the company have? Does the company have multiple offices geographically spread over the country?

The type of work done at the company, i.e. Does the work require physical presence at a specific location (i.e. time- and location-dependent work)? Is remote work possible? Does the work require a lot of displacements to customers (and/or partners, suppliers…) during working hours?

The type of employees working at the firm, i.e. Are the employees typically living close or far away from the company? What is the age distribution of the employees within the company (e.g. lot of young people, lot of employees with children…)? How strong is the war for talent for the desired employees, forcing the employer to offer a lot of extra advantages to attract people?

The size of the company, i.e. a bigger company has the means to setup more complex mobility plans/options, as they often have dedicated people within HR specialized in these setups.

This makes it difficult to define a "one-solution-that-fits-all" approach, but rather a more tailored approach is required, with some degree of customization per customer.

Some examples:

Promoting commuting by bike via bike leasing and a bike allowance is mainly interesting for companies with employees not living too far away from the company and not requiring doing customer or other professional displacements during working hours. Additionally it depends on the profile of the employees and the safety of the trajectory between the home of the employees and the office. Note that 54% of Belgian employees does not want to use a bike to come to work, with the main reason people finding it too dangerous. At the other hand a similar percentage of employees indicates they would be very interested in options like bike leasing and bike allowances.

Shared mobility options are of course only interesting in the bigger cities, where those options are also strongly available. As a result incorporating those options in a mobility plan does not make much sense when the employer is situated in a location where those options are (almost) not available.

The same applies for "multi-modal transportation" (and the associated multi-modal route planners), which are also only interesting in the larger cities where multiple mobility options are readily available. Furthermore a company introducing this multi-modal mobility concept should be able to put a whole change management trajectory in place, as it requires discovering new mobility options and changing existing commute habits (for most employees the commute is a routine activity, which they do in "auto-pilot")

Setting up a Cafeteria plan or Mobility budget can be quite complex, making the costs and effort, especially for smaller firms, not always outweigh the benefits. New digital solutions can provide a (partial) solution to this, but they typically do not take away the uncertainties for employers to deal with something they do not fully understand.

Electric cars are still difficult for people doing large distances on a regular basis, due to their limited action radius and the too low number of charging stations (especially in the South of Belgium). On the other hand for companies where employees come to the office the whole day and that have the required space to setup charging stations, this can be a very interesting option both fiscally and ecologically.

Collective organized transport is typically only economically viable for large companies, for which a large number of employees are coming from the same region. Platforms exist to manage this cross-employers, but this raises a number of other concerns and reduces the added-value.

Options like "no-mobility" (i.e. home working) and "less-mobility" (flex-offices / co-working places) depend on the work culture and the type of work to be done. For some companies the shift to homeworking during the Covid-confinements was already a serious stretch, which will take years to get fully absorbed. Introducing new concepts like "flex-offices" (co-working places) is probably a bridge too far, especially as there is still a lot of unclarity of who will be paying (and what the fiscal implications are) for the office space (employee paying out of his mobility budget or employer paying) and even more for the added-services like drinks, snacks, catering…

…

In general employers have a big interest to do something around mobility, but when having to deal with all complexity (fiscal and operational concerns like policies, load administration…), many employers drop out. Employers fear especially all exceptions, as they often represent hidden costs and lot of extra effort. E.g. what happens if an employee leaves the company? What if someone is fired? What about the liability in case of accidents/theft/vandalism? What will be the exact total cost for me as an employer? How do I need to manage VAT? What is the exact value of benefit of all kind for the employee? Which proofs do I need to collect for the tax authorities? Does it fit with the agreements made in the collective labor agreement of the joint committee?…

These questions mainly originate from the existing unclarities in the fiscal regime, which is due to the fact that many HR managers are not yet acquainted with these new offers, the fact that new mobility offers are created continuously (making it impossible for the government to stay up-to-date) and the continuous change in regulation (e.g. "Mobility Budget", "Company Car Legislation"…).

This lack of maturity in the industry puts a break on the adoption and this maturation might take years to unfold. E.g. meal vouchers took 40 years to arrive to a market penetration of 50%, while this is a much simpler HR product than most mobility options. Until this maturity level is reached, resulting in more well-known, better integrated, more frictionless and cheaper offers, the traditional company mobility options of reimbursing public transport subscriptions and salary cars will remain mostly used. Those are still most widely known by HR managers, are fiscally still very interesting and fit well the needs and desires of most employees.

This last argument is important, as no mobility option will become mainstream unless employees are happy with it. This means the mobility option should not only give a solution for "Professional displacements" but also for the "Private displacements" (in evenings, weekend, holidays…), often with the whole family.

Nonetheless we see the market is maturing and transforming, as millions of euros of VC money are invested in promising new start-ups. Almost all of those start-ups are not profitable yet but given the market potential a few of them could grow out to become unicorns. Today’s students are more acquainted and open for these new mobility services, so likely some of them will become mainstream in the next decade.

Today a whole eco-system of young start-ups and existing incumbent players are offering mobility services, like

Car leasing companies: Alphabet, ALD Automotive, ING Lease, KBC Autolease, LeasePlan, ARVAL…

Car rental companies: Sixt, Avis, Dockx, Hertz, Rent a car…

Car sharing companies (in the form of cars that can be easily used for individual trips up to platforms facilitating sharing your private car or co-driving): Cambio, Poppy, Partago, Zipcar, Cozywheels, Getaround, Dégage, Share Now, Stapp.in, Tapazz, BlaBlaCar, Klaxit, TooGethr, Carpool (Mpact)…

Taxi services: Uber, Wave-a-Cab, Taxi.eu, Heetch, Bolt, Free Now, Allocab…

Bike leasing companies: Ctec, O2O, Joulebikes, KBC-Fietsleasing, B2Bike, Cyclis, Lease-a-bike, Cyclobility, Cycle Valley…

(e)bike, (e)step and scooter sharing & renting: Lime, Dott, Bird, Felyx, Scooty, Villo!, Billy Bike, Mobit, Blue Bike, Swapfiets, Spinlister…

Fuel card and Electric charging card issuing companies: Network Fuel Card, Modalizy, Fleetpass, Belgian Fuel Card (BFC), XXImo, EDI (Electric by D’Ieteren), New Motion, Plugsurfing, Blue Corner, Luminus, EVBOX, Cenergy, Eneco, Dats24, EV-Point,…

Parking companies (either companies providing public parkings or platforms to share individual and company parkings): Yellowbrick, Indigo, QPark, BeMobile, BePark, Pasha, ParkOffice…

Companies helping to define mobility plan and manage setup of policies and mobility plans/budgets: Social Secretariats (SD Worx, Partena, Securex, Acerta, Liantis…), Payflip, Mbrella, MaestroMobile (Espaces-Mobilités)…

MaaS (Mobility as a Service) players: Modalizy, Skipr, Optimile, Olympus, Be-Mobile, MyMove, Vaigo (Eurides), Moveasy…

(Inter-modal) Route planners: Google Maps, Coyote, Waze, Mappy, Jeasy, Skipr, Stoomlink…

Co-working place companies (either companies providing co-working places or platforms allowing to reserve spaces over multiple co-working places): Bar d’Office, Workero, Cowallonia, Burogest, Regus, Welkin, Meraki, Frame 21, Fosbury & Sons, Start it, Coffice, Spaces, House of Innovation, Ampla House, WeWork, Betacowork, Startbloc, SilverSquare…

Expense management solutions for local and international (mobility) expenses: Rydoo, XXImo, MobileXpense, N2F, Certify, SAP Concur, Travel Perk, Trippeo, SpenDesk, Splendid, Declaree, SRXP, Dicom, WebExpenses, Notilus, Expensify, ExpensePath, Abacus, ExpensePoint…

It will be interesting to see which of those companies will still be around in 10 years (i.e. which of the start-up have sufficient funding to bridge the long-time gap to profitability) and to which form they have evolved. Clearly regular pivoting will be required as this market is in full evolution.

Read More

Supply Chain

Article | May 26, 2023

You might be wondering what the benefits are of benchmarking. Well, imagine you are training for a 100 metre sprint in your district. What would be the key number, or metric that you would need to know?

It would, of course, be what the winning time was when this race was last run in your district. Without that information, you don’t know what you’re trying to target. It would be impossible to know if you’ll have any chance at all of winning the race.

It’s exactly the same in business. If, for example, you are concerned about the pick rates in your warehouse, or your transport costs, or your inventory accuracy, benchmarking can help you because it can show you exactly where your performance is compared to others in your industry.

A few years ago, I was working with an automotive parts business. They had a little issue with their picking productivity in the warehouse. They wondered how good it was, whether they could improve it. They actually thought it was okay.

We looked at the figures and compared them with other businesses. This helped us realise that their picking productivity should be three times better than it was. And believe it or not, over a few months they did begin to improve their productivity.

Why? Because benchmarking opened their eyes to the fact that they were at a level quite far below others in the industry.

That’s the beauty of benchmarking. Until you know what others are doing, you can’t be sure how good your performance is.

If you’ve never tried benchmarking, there are three ways you could do it.

1. Informal Benchmarking

This exercise would involve you measuring particular functions or aspects of your business and comparing that against other parts of your business. Let’s say you have a warehouse operating in one city and another operating in another city. You might start to measure the same metrics and see which one is performing better.

You might know other people in the industry who are also operating warehouses so you might agree to share some data with them.

This is probably the easiest way to start off, but it has some downsides:

You’re only measuring against a very small sample size. If all of you in the pool are not that good, how would you know what good is?

You have to make sure that the businesses are similar and you are measuring things in exactly the same way. It’s very important in benchmarking to have a standard way of applying the metric.

2. Formal Benchmarking

This can work for much larger businesses. Perhaps you have operations in many different countries. You could agree a formal structure for how you are going to measure performance. You could do monthly or quarterly benchmarks with all the parts of your international organisation. You could learn from each other and share best practice.

This method is okay but you’re not getting access to a very large pool of results to measure yourself against. You will find that companies are very reluctant to give out benchmarking data. You might also be operating in an environment where the performance is quite low right across the business.

3. Hire a Professional Benchmarking Firm

This is the ultimate way to do it, although there are not a lot of professional benchmarking firms such as ours around. If you do manage to find one, you will quickly realise that there are significant benefits to be had by bringing in the professionals:

The metrics are put together in exactly the same way: When we do a benchmarking exercise for our consulting clients, we go through a very robust data-gathering process and then make sure all the costs, for example, are in the same buckets as everyone else’s in the database.

You gain access to a big pool of results: Professionals have measured hundreds, if not thousands, of companies. This enables you to say, ‘Our company is this size, it operates in this industry, these are the characteristics of our supply chain, who else in that pool of results is like us? We want to be measured against them.”

It’s no good measuring the performance of a grocery retailer, for example, against an industrial product supplier. They have different supply chains. You need to be measuring like with like.

Read More

Software and Technology, Supply Chain

Article | July 14, 2022

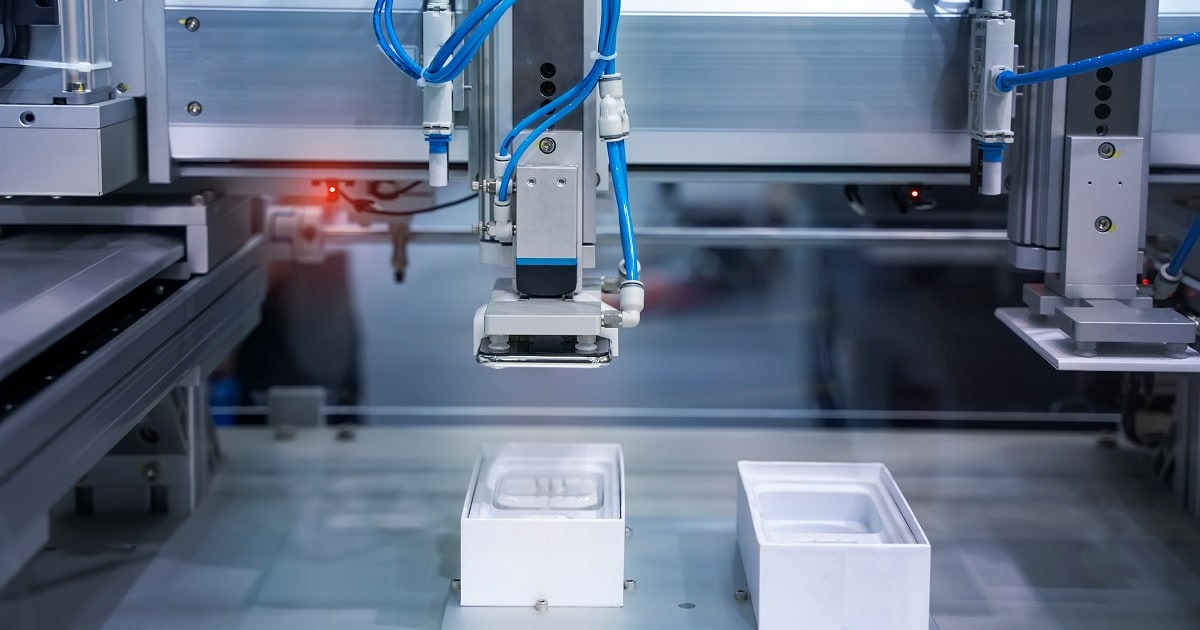

Autonomous robots have transitioned from a futuristic system that only a few enterprises could afford to a sustainable, well-established solution in a wide assortment of warehouse automation projects in recent years.

With the flourishing transportation and logistics industry and increasing e-commerce penetration worldwide, innovative technologies are revealing promising opportunities throughout the supply chain.

Warehouse Automation: Driving Value in the Supply Chain

Historically, autonomous robots have been used to perform tedious and repetitive tasks, necessitating sophisticated programming for setup and incorporation while lacking the dexterity to easily adjust operations.

As autonomous robots become more intelligent, their setup times decrease, they need less monitoring, and they are able to work alongside their human counterparts. The benefits for the future supply chain are increasing as autonomous robots become more capable of working day and night with more consistent levels of productivity and quality and performing tasks that individuals should not, cannot, or do not want to do.

Autonomous robots drive advancements and add value to the supply chain, primarily by increasing revenue potential and lowering direct and indirect operating costs. Autonomous robots, in particular, can assist:

Boost efficiency and productivity.

Lower risk, error frequency, and rework rates.

Enhance employee safety in high-risk workplaces.

Handle low-value, routine tasks so people can work together on strategic projects that can't be done by machines.

Raise revenue by optimizing order fulfillment rates, and delivery speed, and, ultimately, increasing customer satisfaction.

Sneak Peek into the Future of Autonomous Robot

Autonomous robots are expected to witness strong growth in the coming years. These robots will become more common in the future supply chain as technology advances, allowing them to operate with more human-like abilities. Improvements in haptic sensors, for example, will enable these robots to grasp objects varying from multi-surfaced metal assembly parts to fragile eggshells without requiring changes to robotic components or programming. This will encourage companies operating in the industry to increase their research and development activities and introduce innovative and advanced supply chain technologies.

Read More